How to Pay EFTPS Payment Through Credit Card Using Plastiq: Paying taxes is a necessary duty, either by an individual or business entity, and is made simpler by EFTPS. Most taxpayers would wish to have more play in the way of payments, especially regarding the availability of credit card usage. That’s where Plastiq comes into play: a website that allows payments, such as federal taxes, to be paid by credit card. Below is the step-by-step procedure for making the EFTPS payment using credit cards with the help of Plastiq, including the fee applied in such cases and the benefits derived from paying your dues this way:.

What is EFTPS?

The EFTPS, by the U.S. Department of the Treasury, is a free service that gives a channel for paying federal taxes online. It is very secure, always available, and quite easy to use. On the other hand, it is important to underline that EFTPS does not allow any user to pay them directly by credit card, which would, on the other hand, be a big problem in earning credit card rewards or cash flow management.

How does Plastiq work?

With the help of a service called Plastiq, one can make bill payments, which include taxes, using their credit card. It then forwards that payment to the recipient, be it the IRS or another federal body. The website will charge a little extra for this service, but for most, this is a small price to pay for the advantages of paying by credit card. Now that we have our tools at hand, let’s walk through the actual steps necessary to make an EFTPS payment using Plastiq.

How to Pay EFTPS via Plastiq: A Step-by-Step Guide

How to Pay EFTPS via Plastiq: A Step-by-Step Guide

- Create an EFTPS Account

To begin with, you are going to need to set up an EFTPS account if you have not already. Here is how:

Go onto the official EFTPS website.

Click on “Enroll” and follow the on-screen prompts.

Within 5-7 business days after enrolling, you will receive a PIN and instructions in the mail.

Once you have your EFTPS PIN, you’re ready to proceed with the next steps.

- Create a Plastiq Account

If you do not already have a Plastiq account, you would want to create one:

Go to plastiq.com and click “Sign Up”.

Enter your basic information: name, email, and password.

Verify your email to complete the registration.

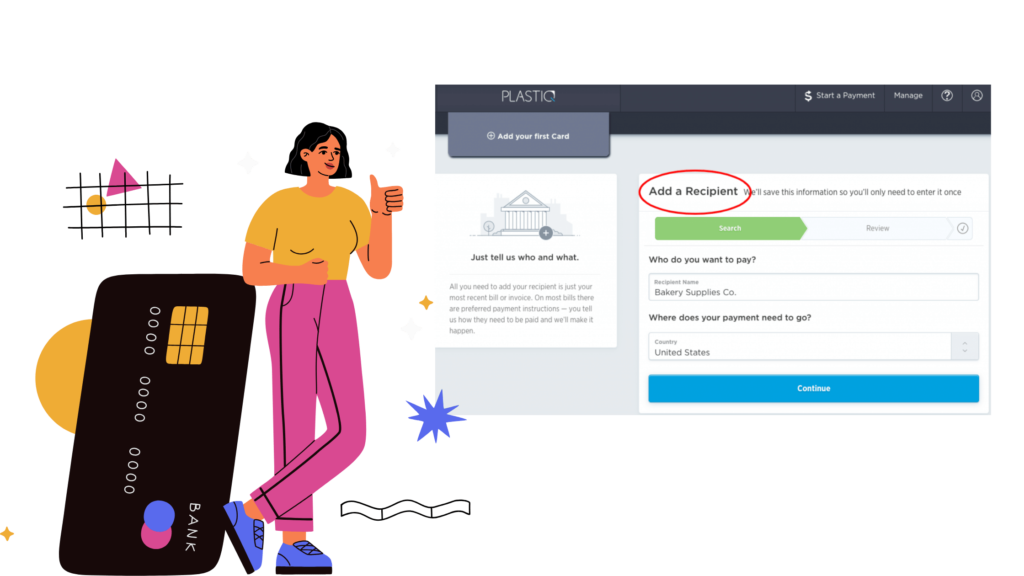

- Set Up Your Payment on Plastiq

Now that you’re registered on Plastiq, you can go ahead and set up your EFTPS payment:

Log in to your account on Plastiq. Click Add a Recipient. In the dropdown menu, select Federal Government and select EFTPS as the recipient. Enter the required information: providing your EFTPS account number and details of your payment. Select a Credit Card as your payment method.

4. Confirm Your Payment

After you enter the details above, you will need to:

Confirm the amount that you want to pay with the help of Plastiq.

Double-check all the payment information to ensure your EFTPS account and amount are correct.

Scanning the Plastiq service fee-AROUND 2.85%

- Complete Your Payment

Plastiq will go ahead and charge your credit card the above sum, forwarding the payment to the EFTPS. You shall receive an email with all the details of your payment, which you can save for future reference.

Benefits of Paying EFTPS Taxes with Plastiq

- Earn Credit Card Rewards

One of the major reasons taxpayers choose Plastiq for paying taxes is to earn credit card rewards. Whether you’re aiming to gain miles, cashback, or other types of points, using your credit card via Plastiq will help you reach your reward goals more quickly. - Improve Cash Flow Management

If you have problems with liquidity or need to have more flexibility in the payment of your dues, credit card payment allows you to extend your due date without penalties from the IRS. Businesses that may have their cash flow tied up during peak seasons, find such a payment option useful. - Convenience and Ease

Paying your tax is quite easy with Plastiq. You will not have to deal with different systems for your payment. You manage everything on a single platform and make your EFTPS payment using your credit card typically non-credit-card-friendly payment option.

Fees Involved

The only real disadvantage of using Plastiq is that there is a service fee when you use it. Generally, it’s 2.85% of the total amount you pay. That’s something to keep in mind as you elect to use this service; the costs can add up for larger tax payments.

For instance, if you owe 5,000 dollars in federal taxes, the fee for using Plastiq will be approximately 142.50 dollars. If the rewards you’re getting from your credit card outweigh this fee, or if you need the extended payment time, using Plastiq could be worth it.

Tax Deductions

Another thing that may be taken into consideration would be the tax deductibility of the Plastiq service fee. Generally, the IRS allows the deduction of all expenses and costs about operating a business, which for some business owners may include credit card processing fees. However, it would be best to consult with a tax professional regarding the eligibility of deducting this particular fee from your taxes.

Potential Drawbacks

With all the convenience and rewards, there are also some potential downsides to using Plastiq:

Service Fees: The identified 2.85% service fee can get pretty expensive, especially for larger payments.

Processing Time: Plastiq’s payment processing alone may take up to several business days before reaching EFTPS, so one must plan well in advance and avoid late fees from the IRS.

Limited Card Acceptance: The idea is that not all credit card issuers allow payments for federal taxes through Plastiq, so it is very important to check with a card provider beforehand.

read also: how-to-guide-for-walmart-credit-card-troubleshooting-faqs

FAQs

Can I use Plastiq for credit card payments for my federal taxes?

Yes, you may avail of the services offered by Plastiq to pay your federal taxes by credit card through the Electronic Federal Tax Payment System. Plastiq is actually just a third-party service that takes a minor charge as a fee for this convenience.

How much does Plastiq charge when I pay my taxes through a credit card?

The average regular service fee for Plastiq runs around 2.85% of the amount to be paid. This rate may vary depending on your payment method and type of card.

How long will it take Plastiq to process my payment?

The usual processing with Plastiq takes three to five business days for them to process and deliver your payment to EFTPS. You should plan to make a payment to avoid any late fees with the IRS.

Do I get credit card rewards by making the tax payment via Plastiq?

Yes, you earn credit card rewards for paying your federal taxes with Plastiq through your credit card. It could be in the form of cashback, points, or even airline miles, depending on your credit card’s reward system.

Conclusion

Paying EFTPS taxes using a credit card with Plastiq comes with merits in earning rewards, improving cash flow, and adding convenience to your bill payments. On the other side, you should consider the service fee and the time it takes to be processed, from which you can deduce whether the option will suit you. The steps highlighted above will help you easily and securely manage your federal tax payments with the flexibility to use a credit card.